where's my unemployment tax refund tool

Paper Return Delays If you filed on paper it may take 6 months or more to process your. Go to My Account and click on RefundDemand.

Where S My Refund Tax Refund Tracking Guide From Turbotax

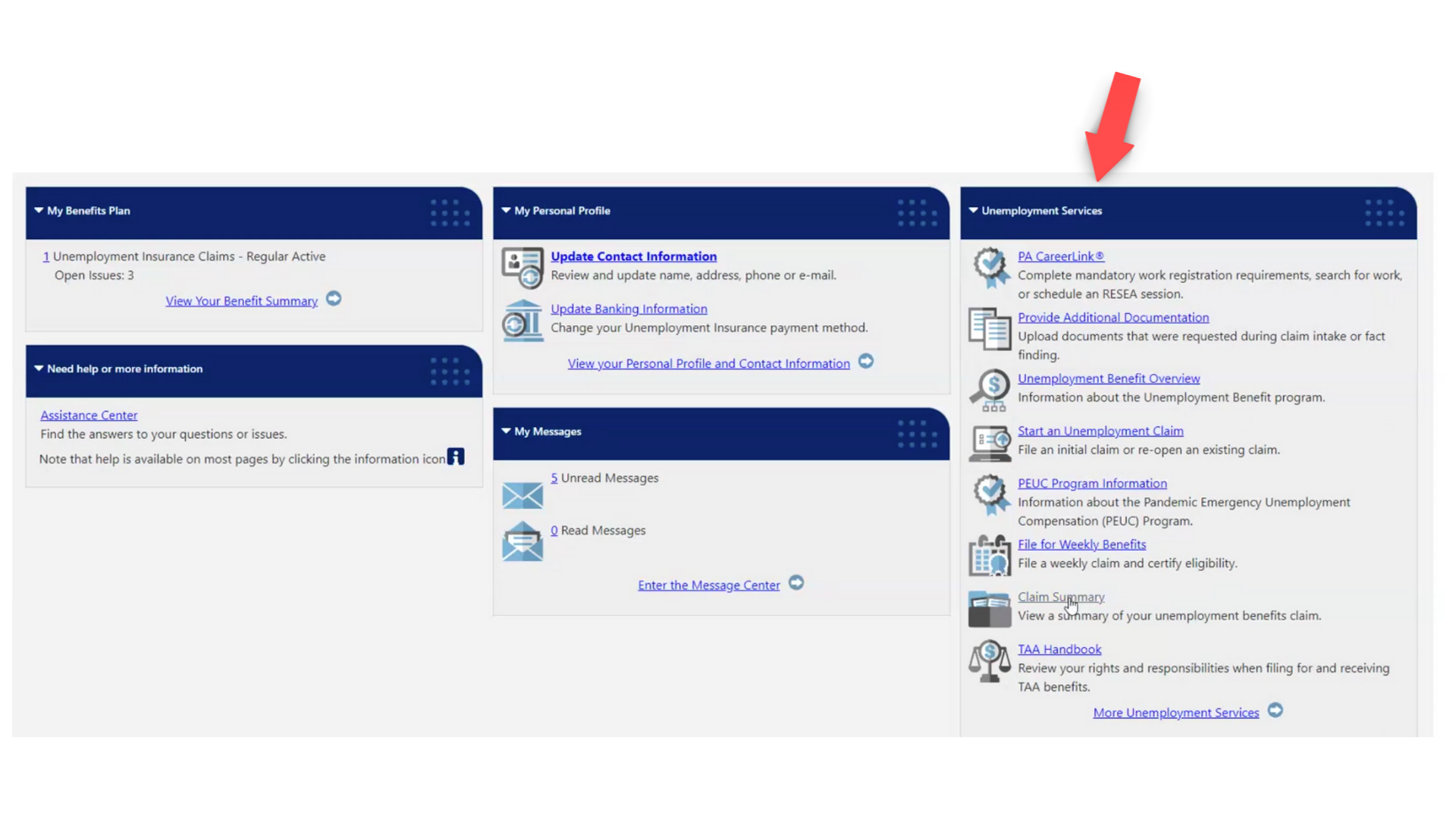

Unemployment Refund Tracker Unemployment Insurance TaxUni.

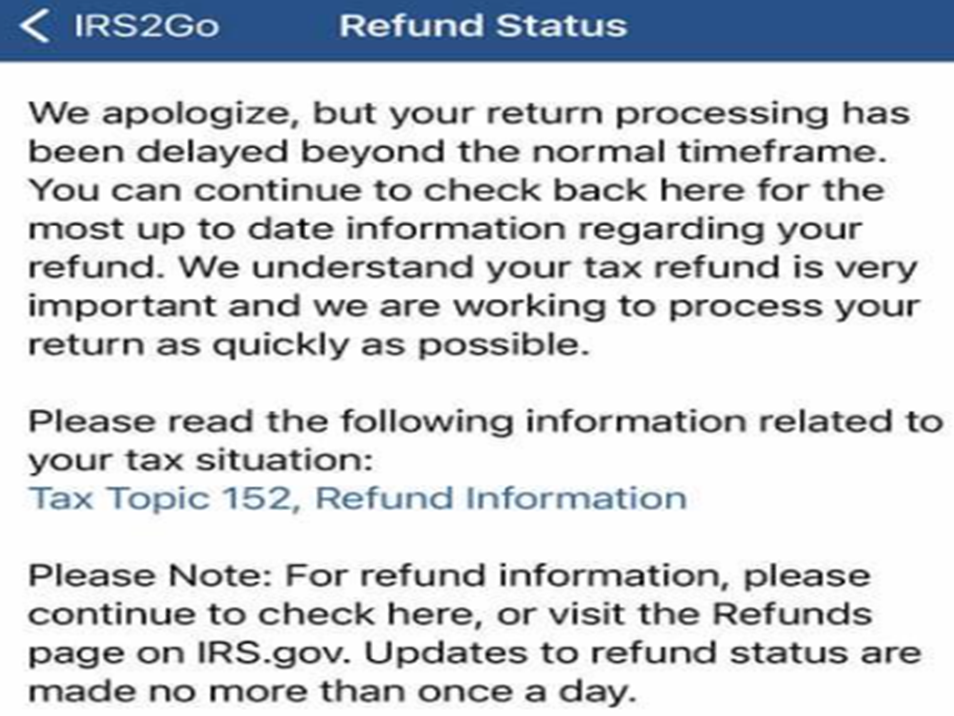

. Viewing the details of your IRS account. The Wheres My Refund. Get information about tax refunds and track the status of your e-file or paper tax return.

Whether you owe taxes or are awaiting a refund you may check the status of your tax return by. Login to e-Filing website with User ID Password Date of Birth Date of Incorporation and Captcha. Why is my refund taking so long.

Using the IRSs Wheres My Refund feature. Heres a list of reasons your income tax refund might be delayed. Their Social Security number.

If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records. If youre anticipating an unemployment tax refund your best bet is to track the status of it and see. You can check the status of your current year refund online or by calling the automated line at 260-7701 or 1-800-218-8160.

The IRS has sent 87 million unemployment compensation refunds so far. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency finally. Income Tax Refund Information.

Your tax return has errors. This tool gives taxpayers access to their tax return and refund status anytime. How To Track Your Refund And Check Your Tax Transcript.

Check your unemployment refund status using the Wheres My Refund tool like tracking your regular tax refund. The Internal Revenue Service doesnt have a separate portal for checking. All they need is internet access and three pieces of information.

Is the IRS sending out unemployment refunds. The first way to get clues about your refund is to try the IRS online tracker applications. You filed for the earned income tax credit or additional child tax credit.

If you filed an amended return you can check the Amended Return Status tool. Your return needs. The IRS has cautioned that the refund is is subject to normal offset rules the IRS said meaning that it can be used to cover past-due federal tax state income tax state.

View Refund Demand Status.

The 2022 Tax Season Has Started Tips To Help You File An Accurate Return Internal Revenue Service

Some Tax Refunds May Be Delayed This Year Here S Why Cbs News

The Irs Has Sent Nearly 58 Million Refunds Here S The Average Payment

Just Got My Unemployment Tax Refund R Irs

Tax Refund Status Is Still Being Processed

Where S My Tax Refund The Irs Refund Timetable Explained Turbotax Tax Tips Videos

Wmr And Irs2go Updates And Status Changes Return Received Refund Approved And Refund Sent Aving To Invest

How To Check Your Irs Refund Status In 5 Minutes Bench Accounting

Unemployment Benefits Tax Issues Uchelp Org

Dor Unemployment Compensation State Taxes

10 200 Unemployment Tax Break Refund How To Know If I Will Get It As Usa

Irs Unemployment Tax Refund Timeline For September Checks

Irs Issued 430 000 More Unemployment Tax Refunds What To Know Cnet

What To Know About Unemployment Refund Irs Payment Schedule More

Unemployment Benefits Tax Issues Uchelp Org

Here S How To Track Your Unemployment Tax Refund From The Irs The Us Sun

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Irs Starts Sending Unemployment Benefits Tax Refunds To Millions Of Taxpayers Plus More Special Refunds Payments On The Way

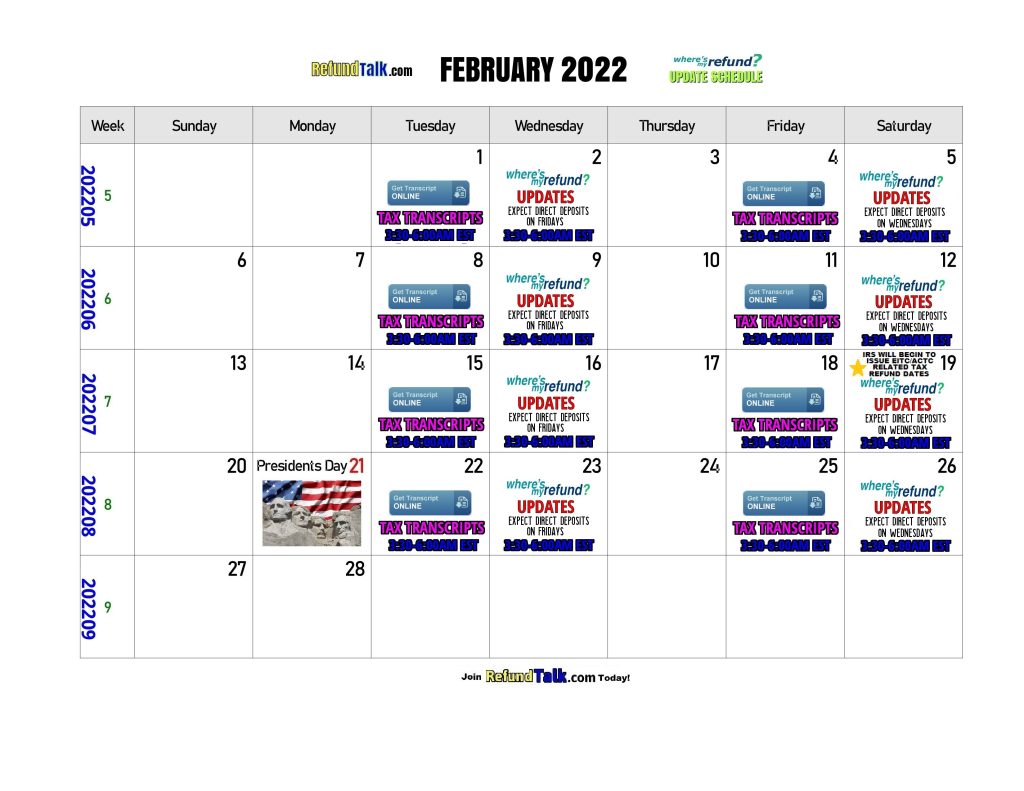

Tax Refund Updates Calendar Where S My Refund Tax News Information